contra costa sales tax increase

Contra Costa County Measure X was on the ballot as a referral in Contra Costa County on November 3 2020. The Contra Costa Board of Supervisors voted to use 10000 to do polling to see if the people would accept a sales tax increase.

Breast Cancer Awareness Month National Breast Cancer Foundation

Restaurants In Matthews Nc That Deliver.

. The Post COVID New World Order presentation. Actually the purpose of the poll is to decide what message would sell best to scam the public out of its money. You can see a list of all cities with tax increases in effect.

The Contra Costa County Sales Tax is 025. A county-wide sales tax rate of 025 is applicable to localities in Contra Costa County in addition to the 6 California sales tax. City officials say it would generate approximately 24 million annually.

Opry Mills Breakfast Restaurants. Contra Costa Supervisors move forward half-cent sales tax increase for November ballot extend rental eviction moratorium. Contra Costa County Sales Tax Increase 2021.

Gavin Newsom signed into law a variety of bills on Thursday including SB1349 by State Senator Steve Glazer allowing a countywide half-cent sales tax increase which is designated Measure X on the November ballot in Contra Costa. Finally Measure X passage would leave at least seven Contra Costa city and town jurisdictions above the statutory 2 cap on local sales taxes. State Senate Bill 1349 passed and signed at the last minute allows the Countys sales-tax cap to increase from 2 effectively to at least 3.

The supervisors will also receive a report on Capital Projects the Facilities Condition Assessment and the Facilities Master Plan. This is the total of state and county sales tax rates. The current total local sales tax rate in Contra Costa County CA is 8750.

Each of the Contra Costa Transportation Authoritys two recent sales-tax-increase campaigns Measure X 2016 and Measure J March 2020 was bankrolled by about 13 Million in contributions made primarily by existing and prospective vendors and contractors to the County with an odor thereby of shakedowns and anticipated kickbacks. Majestic Life Church Service Times. Contra Costa County.

So an underhanded legislative scheme was deployed. The Contra Costa sales tax measure will depend on passage of state Senate Bill 1349 drafted by Sen. This is why government is not trusted or respected.

It was approved. The increase reflects a robust recovery in. Siskiyou Co Local Tax Sl.

Some cities and local governments in Contra Costa County collect additional local sales taxes which can be as high as 45. On the last day possible Gov. It would raise an existing one-half cent sales tax to one cent for 20 years.

City of Concord located in Contra Costa County 8750. That would bring Contra Costas sales-tax rate up to around 10 percent. Steve Glazer D-Orinda that would authorize the county to impose a transactions and use tax of.

A yes vote supported authorizing an additional sales tax of 05 for 20 years generating an estimated 81 million per year for essential services including the regional hospital community health centers emergency response safety-net. The Contra Costa County California sales tax is 825 consisting of 600 California state sales tax and 225 Contra Costa County local sales taxesThe local sales tax consists of a 025 county sales tax and a 200 special district sales tax used to fund transportation districts local attractions etc. The California state sales tax rate is currently.

Contra Costa County CA Sales Tax Rate. Weed Montague Fort Jones Etna Mccloud Dorris Happy Camp Hornbrook Grenada Macdoel Forks Of Salmon Klamath River Seiad Valley Somes Bar Scott Bar Greenview Callahan and Gazelle. Saratogas hotel and sales taxes were about 40 higher this year than last year.

A new half-cent sales tax to raise an estimated 81 million a year mostly for social services moved closer to the November election ballot Tuesday but delays in passing a certain state Senate bill could still derail it. If it passes sales tax would increase by half a percent on most goods but not on necessities like food and medicine. 2 The city increased its existing tax of 050 percent GZGT to 100 percent GZTU and extended the expiration date to March 31 2044.

Restaurants In Erie County Lawsuit. Contra Costa County California Sales Tax Rate 2022 Up to 1075. Otay Chula Vista 8750.

Contra Costa Supervisors Scam Tax to Scam MORE Taxes. A yes vote supported authorizing an additional sales tax of 05 for 20 years generating an estimated 81 million per year for essential services including the regional hospital community health centers emergency response safety-net services early childhood services and protection of vulnerable populations thereby increasing the total sales tax rate in Contra Costa County. The minimum combined 2022 sales tax rate for Contra Costa County California is.

1 The city increased its existing tax of 050 percent CNCD to 100 percent CNTU in addition to the Contra Costa countywide increase of 050 percent listed in the countywide table. Contra Costa County voters passed the Measure X countywide half-cent sales tax increase on the November 2020 ballot. City of San Rafael located in Marin County 9000.

Raised from 725 to 775. Had the governor vetoed the bill the votes would not have counted. Are Dental Implants Tax Deductible In Ireland.

As Contra Costa Countys transportation sales tax agency the Authority oversees the design and construction of the transportation projects included in the Expenditure Plans carries out the programs included in the Expenditure Plans most notably the countys Growth Management Program and provides the financial structure that ensures the. The December 2020 total local sales tax rate was 8250. The Contra Costa County sales tax rate is.

Wed Jul 29 2020 1033 am 4. The votes on that measure will now count. Pacific Palisades Los Angeles 9500.

That would bring Contra Costas sales-tax rate up to around 10 percent.

Ukraine War News From February 28 Russian Forces Bombard Kharkiv Ukraine Holds On To Major Cities Talks End Without Ceasefire Financial Times

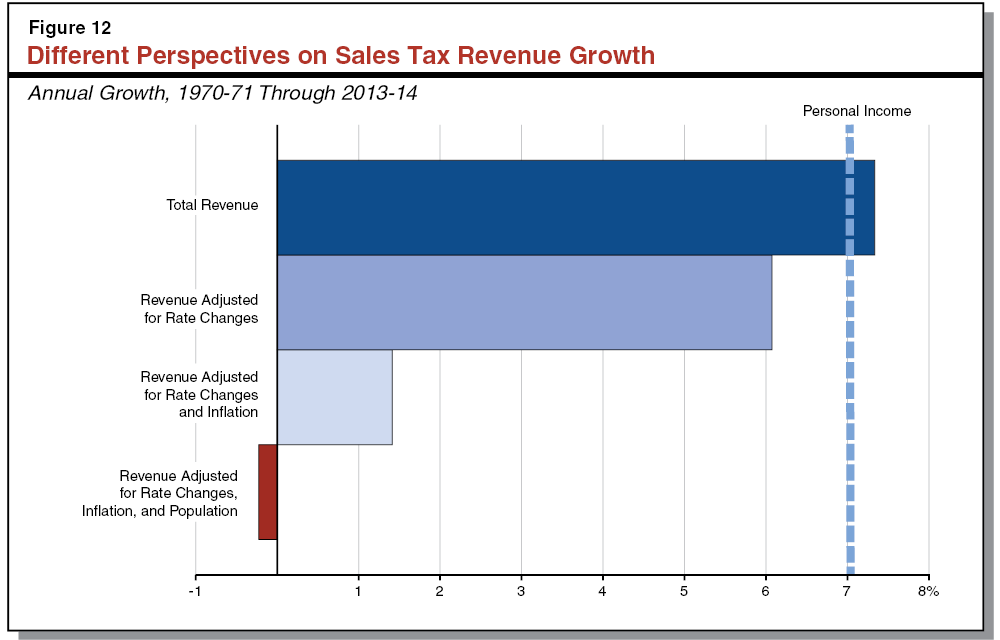

Understanding California S Sales Tax

Ukraine War News From February 28 Russian Forces Bombard Kharkiv Ukraine Holds On To Major Cities Talks End Without Ceasefire Financial Times

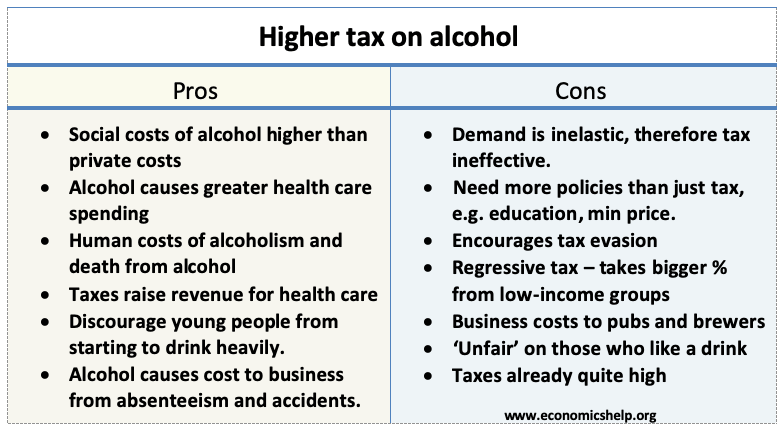

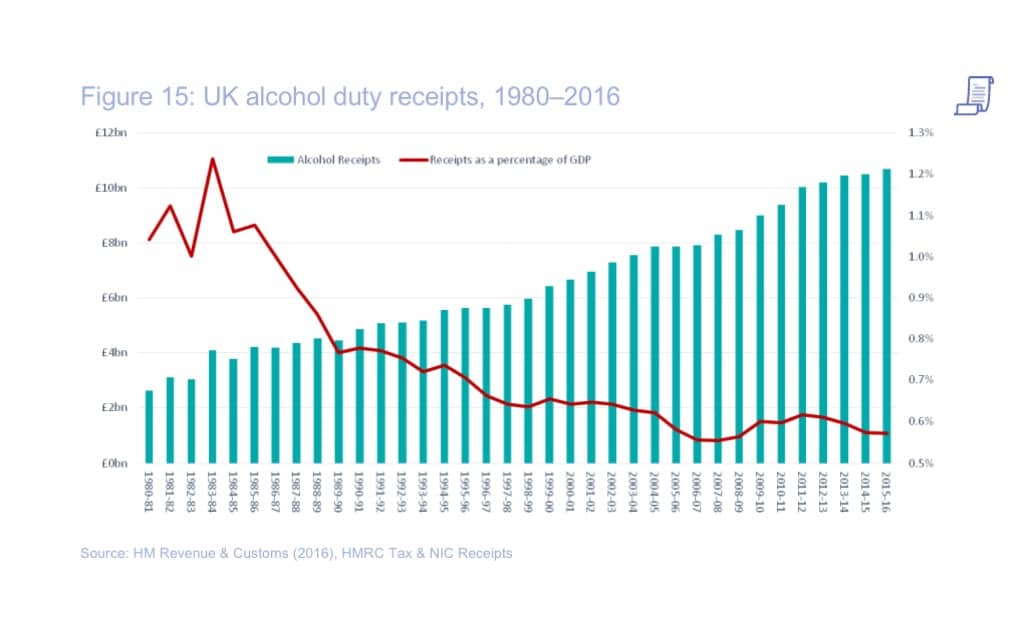

Pros And Cons Of Higher Tax On Alcohol Economics Help

Equitable Financing For Nutrition Global Nutrition Report

California Sales Tax Rate Changes April 2019

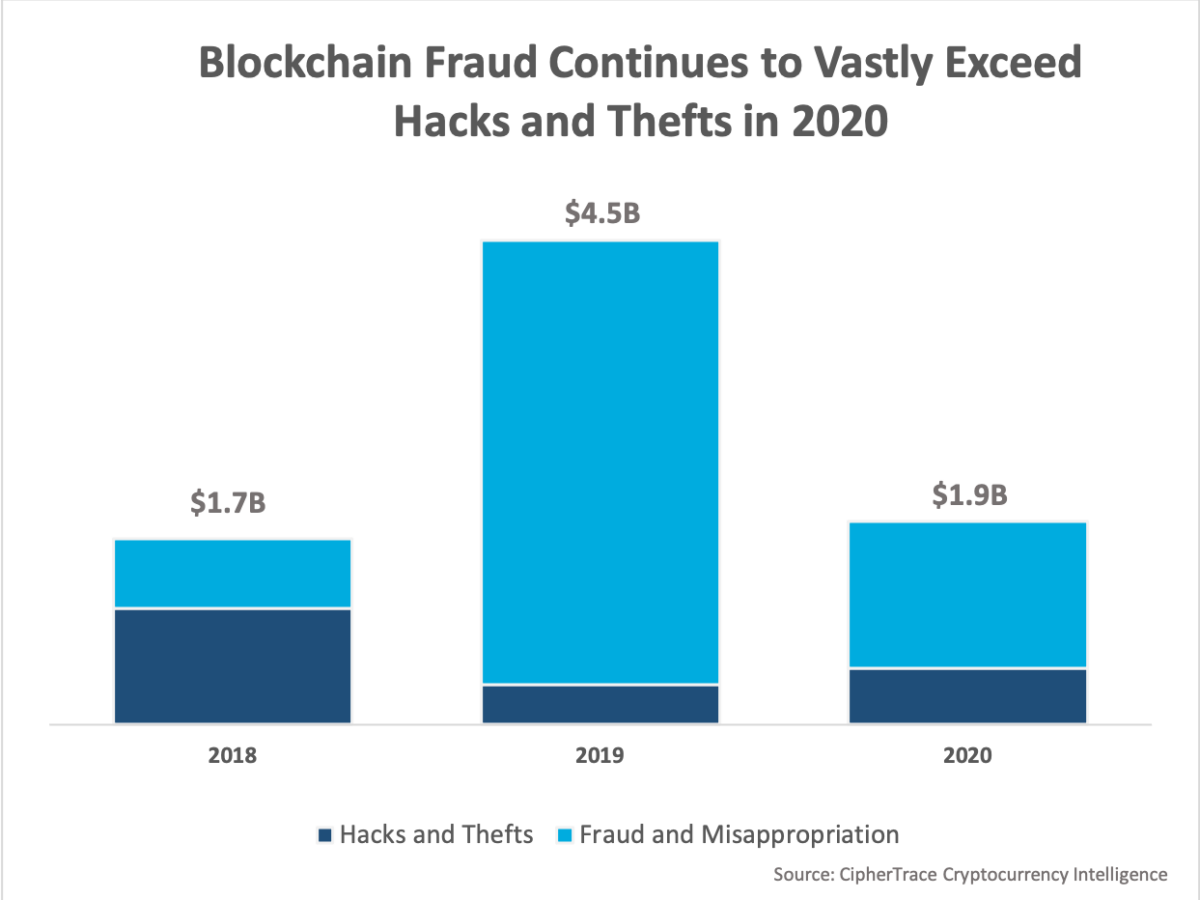

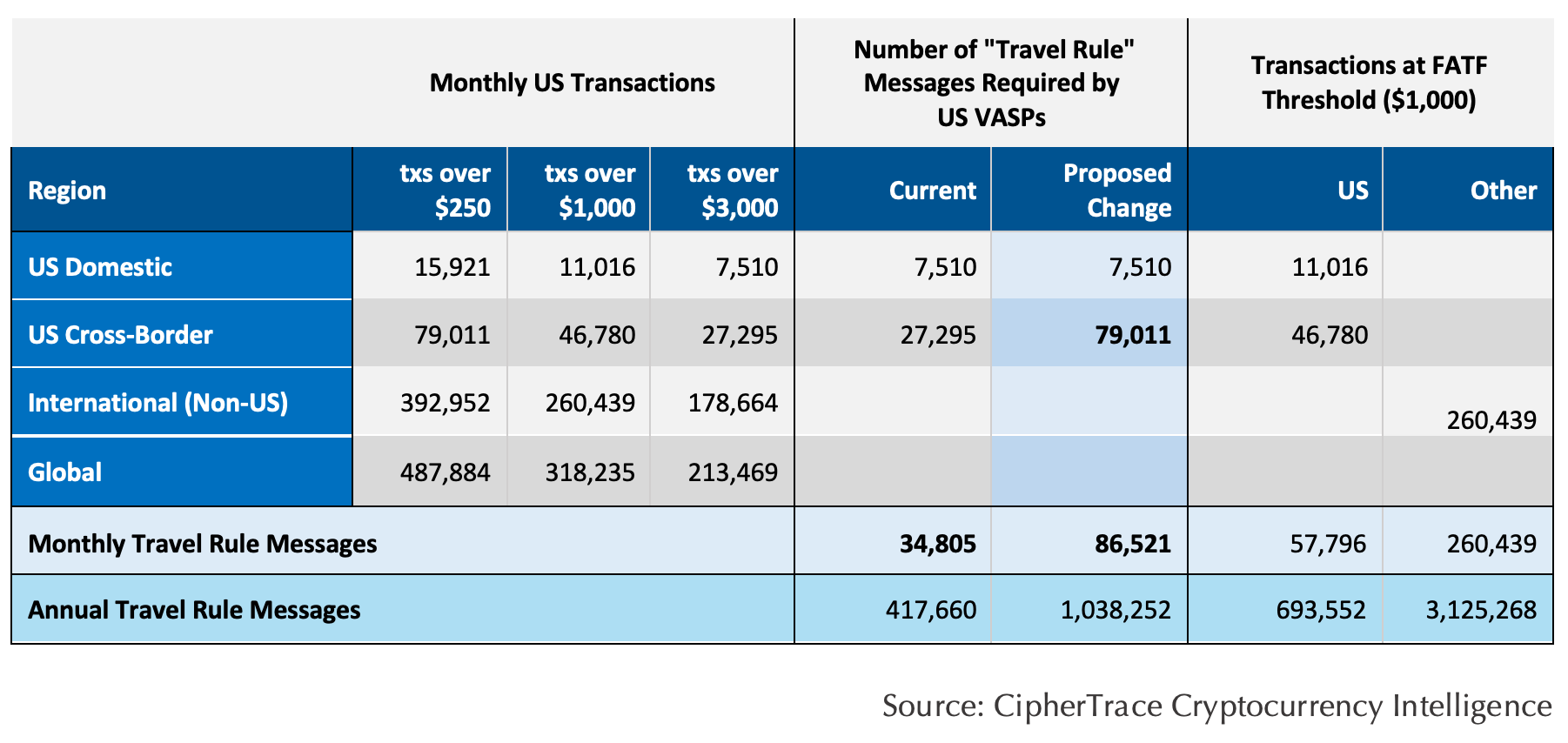

Cryptocurrency Crime And Anti Money Laundering Report February 2021 Ciphertrace

Cannabis Cultivation Tax Rates To Increase On January 1 2022 Law Offices Of Omar Figueroa

Equitable Financing For Nutrition Global Nutrition Report

Top 10 Opportunity Zones With Median Home Prices On The Rise Attom

Cryptocurrency Crime And Anti Money Laundering Report February 2021 Ciphertrace

Vote No On The Measure X County Services Sales Tax Increase

/GettyImages-6034-000797-38dfc99517fa46fcae80718888454e3b.jpg)

Inflation Vs Deflation What S The Difference

Full List Sales Tax Increase Now In Effect Across California Kron4

European Flag European Commission Brussels 4 2 2022 Swd 2022 24 Final Commission Staff Working Document Cohesion In Europe Towards 2050 Accompanying The Document Communication From The Commission To The

Pros And Cons Of Higher Tax On Alcohol Economics Help

/dotdash_final_What_Costs_Are_Not_Counted_in_Gross_Profit_Margin_Nov_2020-01-081605ccd5dd4d37983c775f12bb4f5f.jpg)

What Costs Are Not Counted In Gross Profit Margin

Ken Fox Bay Area East Bay Modern Real Estate Marin Modern Real Estate San Francisco Modern Real California Real Estate Bay Area California Bay Area Housing